Covered Call Example: ~$200 in 3.5 months

An example of selling a covered call for income designed to hold the shares after expiration but with a significant chance of having to sell

The goal is to make around $200 in roughly 3.5 months by selling a covered call with the idea that you would like to keep the shares but are okay if you have to sell them.

$200 in 3 months might not sound like much, so I will put it in other terms.

Make 3% passive income in roughly 3.5 months. Annualized, that is around 10% before taxes. Checking and savings accounts cannot match that with 1-2% yields. Even good dividend stocks are less, maybe around 3-5% yearly.

Covered calls are riskier and require more hands on work than bank accounts and dividend stocks, but you may like that about options. The returns are good and it is fun analyzing, making decisions, and seeing the results.

Plus, just like bank accounts and stocks play specific roles in your financial life, options are just another tool that you can use. When used correctly, options can be fun and financially rewarding.

Covered Call

A covered call is when you sell someone the option to buy shares of stock from you that you already own.

The call is considered covered because you already own the shares and can therefore deliver if the option buyer exercises the option.

The call is not covered if you sell the option but do not actually own the shares. That is considered margin trading and is beyond what we do here.

Otherwise, the call is typical. The buyer can call the shares away from you if the shares exceed the strike price.

Example Covered Call

Pretend you own 100 shares of Cash Enterprises and that those shares trade on the market at $20 per share. You bought them years ago for much cheaper.

You like the stock long term, but it has not made any exciting share price increases lately and you want to take advantage of that.

You sell an option to someone for 25 cents per share. This totals $25 because the option is for 100 shares. The option contract expires in 3 months with a strike price of $23 per share.

So only if the stock increases more than 15% in 3 months, from $20 to $23, do you have to sell the shares at $23 per share. Even if the shares are then trading above $23, say for example at $30, you still sell at $23.

Regardless, you keep the $25 option contract sale price.

What you want . . .

A great outcome is if the option contract expires when the shares are trading just below $23 and then after expiration the stock keeps increasing.

You keep the $25. A more than 1% gain on your $2,000 cover in 3 months.

You also keep shares that are increasing in value. If they stay above $23 after the option expires, your shares are now at least 15% more valuable than 3 months ago and are continuing to increase.

You could sell the shares maybe for $30 per share or even higher, sell another option contract for more than $25 because now the cover is more valuable, or keep holding the stock.

But what if the shares decrease in value during or after the option contract period?

Well, you earned $25 dollars and your cover is less valuable.

For instance, if the stock dropped to $18 per share, your $2,000 cover is now worth only $1,800. Plus, the options prices might have decreased too, hurting your gains for future options sales.

This highlights that keeping the stock after the option expires is not by itself a good thing. Rather, keeping a good stock after the option expires is the good thing.

Therefore, it is important to emphasize that the covering shares of stock are shares that that you want to hold for the long term.

So if the stock does drop, you want it to be a stock that you feel confident will increase in value in the long term and be much higher than $20 per share someday. Maybe the drop is a temporary dip in price.

But what if the option expires above the strike price . . .

If the stock trades above $23 at the option contract expiration date, you keep the $25 option income and sell the stock for $23 per share regardless of what its actual price is.

In total, you pocket $2,325.

$23 x 100 shares + $25 = $2,325In three months, you earned $3 per share from the 15% share price increase from $20 to $23. You also earned the $25 option income adding another ~1% to your gains.

Therefore, your $325 gain from $2,000 to $2,325 is an increase of 16.25% in 3 months.

Despite the gain, you lose the upside of the stock because you no longer have the shares.

(Stock price after expiration) - $23 = (What you miss out on)So if the stock doubles to $40, you miss out on $17 per share. That is $1,700 because underlying each option contract is 100 shares.

$40 - $23 = $17

$17 x 100 = $1,700You can avoid or minimize missing out on that upside, however, by making smart decisions before and after contract expiration.

Real Example Analysis

Consider a real example using PayPal.

Look at the Options Chain

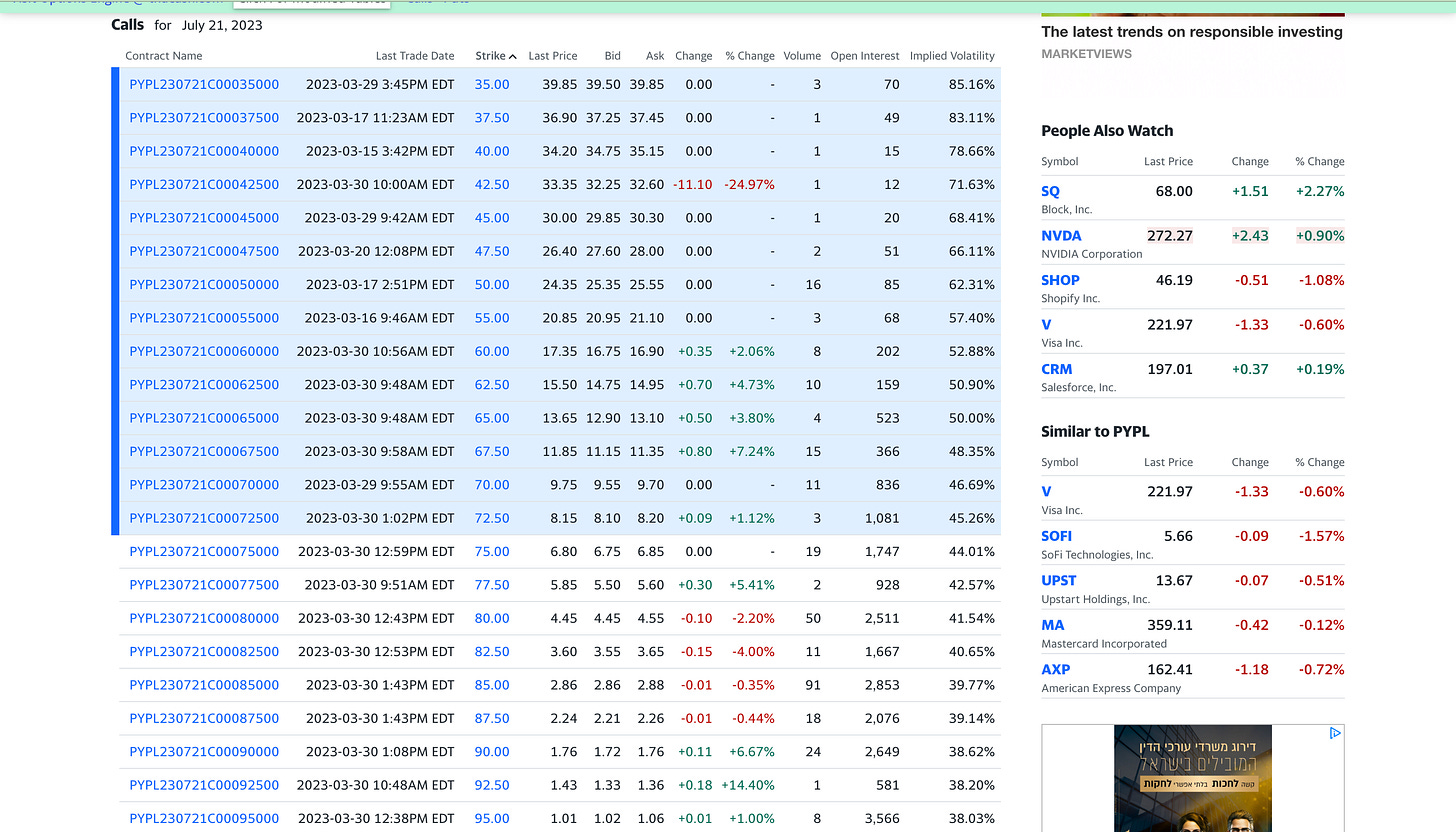

As of March 30, 2023, PYPL trades at around $74 per share.

If you own 100 shares of PYPL, the cover for a covered call is worth around $7,400.

$74 x 100 = $7,400From March 30, 2023 until July 21, 2023 is a little more than 3.5 months.

Here is the options chain for the July 21, 2023 options for PYPL.

Look at the options chain for a strike price greater than the current price of $74 per share.

But how much greater? Is a $75 strike price okay? How about $85? Something else?

It depends on your investing goals.

If you want to hold the shares for the long term, consider a strike price greater than where you think the stock will likely be in 3.5 months.

How do you know how much PYPL is going to change between March 30 and July 21?

You don’t.

But maybe you can make an informed decision to help stack the odds in your favor.

One thing to consider is past performance.

Although past performance is not a guarantee of future results, it can nonetheless be informative sometimes.

Check out the chart below.

PYPL is up 2% in the 90 days preceding March 30, 2023.

Last year at this time, PYPL shares were down 40% over the preceding 90 days, from Jan 2022 until March 30, 2022. Then it fell another 34% over the following 90 days, from April until July.

Two years ago at this time, it was up roughly 4% over the preceding 90 days, from Jan 2021 until March 30, 2021. Then it rose over 21% over the following 90 days, from April until July.

See the chart below for the last 5 years.

In the last 5 years, only once did PYPL significantly exceed 20% increase in the 90 days following March 30.

Therefore, selling a covered call for PYPL comes with significant risk that you might have to sell.

But you might be okay selling PYPL under certain conditions.

If you are okay with potentially selling your PYPL shares, consider the potential options income.

Look at the options chain again but with some calculations . . .

Below is the same options chain as above but with two new columns on the left. I added the columns with a Chrome extension that I made for Yahoo Finance’s options pages.

The left column is called Price Change Exp. It is the price change from the current price to the strike price. So you can know how much the stock would have to move for the shares to be called away.

The column to the right of it is called Seller Inc %. I took the average of the bid and ask prices, divided the result by the current stock price, and multiplied that by 100. So you can know how much that cover is working for you in terms of option seller income.

Do you want to sell “to hold”?

If you select a strike price of $87.50, you earn roughly $220 as option income and have a good chance of keeping the shares after the option expires.

The $220 option income is based on the bid and ask prices of 2.20 and 2.25 times 100 shares.

The $220 earns you 3% of the $7,400 cover in just over 3.5 months.

Plus, the stock needs to increase more than 18% from today’s price for you to have to sell at expiration. That means a good window exists for the stock to increase without you having to sell.

So you have a good chance of keeping the shares at the $87.50 strike price. If you have to sell, at least you make 18% more upside on the shares beforehand.

What will PYPL do in 3.5 months?

PYPL has a significant chance of exceeding an 18% increase based on the chart above for the last 5 years but is more likely not to.

However, you cannot consider just the 5 year chart. You also have to consider current market conditions and other factors beyond the scope of this example. Remember to do your own research and not rely just on this article.

Regardless, if you have to sell, you pocket the $8,970.

A 21% increase on your $7,400!

$87.50 x 100 shares + $220 = $8,970In contrast . . .

If you select a strike price of $75 dollars, you earn roughly $680 as option income. The $680 is based on the bid and ask prices of 6.70 and 6.85 times 100.

That is 9% of the $7,400 cover. That is big income in 3.5 months. However, only a 1% increase in stock price from current value means a good chance you will have to sell the shares. If you sell, you only get another 1%.

So roughly 10% gain total.

Compared to the 21% gain with the $87.50 strike price and the loss of shares at $75, this looks not so good.

If you are not comfortable with the risk of having to sell at the $87.50 strike . . .

Consider a strike price greater than $87.50 to reduce the chances you will have to sell the shares. However, the option income decreases as the strike price increases.

Summary

If you want to sell a covered call but ultimately want to hold the underlying shares no matter the outcome, consider a strategy similar to the $87.50 strike price for PYPL above. The option income is good and the stock has enough room to run up without you having to sell.

Although roughly $200 in in 3.5 months will not get you much wealth by itself, using the strategy consistently over time and with greater cover values can generate solid passive income.

Remember to do your own research before investing in stocks or selling options. Do not rely just on this article as my information may not be timely or accurate.

Make smart decisions and do not take on more risk than you feel comfortable with. Consult a professional financial advisor instead of relying on my information.