Options Calculator for Covered Calls and Secured Puts

Save time and boost your investment returns with the options calculator.

Easily analyze options contracts and develop strategies for covered call and secured put strategies in less time and with greater ease.

The options calculator is located on my website. I built the calculator using Yahoo Finance stock data and NextJS.

Yahoo Finance is one of the leading sources of financial information. NextJS is a JavaScript framework for making full-stack web applications.

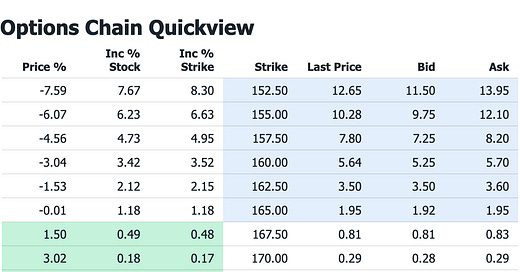

Here is an example of the options calculator for Apple stock.

Read below for more about the following.

Why use the options calculator?

What does the options calculator do?

Thoughts on options strategies

Why use the options calculator?

The options calculator makes it easier and less tedious to analyze options contracts.

Personally, I sell options and use the calculator to decide which options to sell.

Before building the options calculator, when selling covered calls and secured puts, I would look at the options chain for a particular stock on Yahoo Finance, pull out my calculator, and run the same set calculations for a variety of options contracts.

Although fairly easy, doing the calculations is time-consuming and distracting.

Plus, the prices would change or I would change my line of research and have to re-do the calculations for a new set of options chains.

Unfortunately for me, the options chains do not already contain the calculations that I am interested in or explain the possible scenarios. So these time-consuming and distracting task falls on me.

To streamline my analysis, I built the options calculator.

The options calculator uses data from options chains to automatically calculate important information for me and explain possible outcomes for each option contract in the options chain.

What does the options calculator do?

The options calculator features options chain tables with additional calculations done for you and detailed explanations of the current situation and possible outcomes.

For instance, the options calculator has an options chain table with columns for the following.

the percentage the current stock price has to move to change from in the money to out of the money

the option seller income as a percentage of the current stock price

the option seller income as a percentage of the strike price.

The table also highlights in green the rows that are out of the money. Those rows currently tend to interest me the most as an options seller looking 3 to 4 months out.

To see the explanations for each option contract, simply click a row in the options chain.

Then read the text explaining the current situation and the different scenarios for what could happen if the contract expired in the money or out of the money.

Here is part of an example options contract explanation.

The options calculator also features additional tables and calculations to help you understand how the stock price has moved in the past.

Keep in mind that past performance is not a guarantee of future results and it is very hard to predict how the market will move.

But . . .

Although past performance is not a perfect indicator, past performance can nonetheless be helpful for understanding how the stock price might move.

And although timing the market is hard, it helps to at least try to stack the odds in your favor by using time as a tool instead of ignoring it.

Therefore . . .

One feature the options calculator has for you to look at how a stock might perform is the price history tables.

Here is an example for an options strategy looking at expirations dates 3 to 4 months in the future.

You can also search the options calculator for stocks by symbol, change from calls to puts, and change the expiration date.

Thoughts on options strategies

The options calculator does not provide investment advice or recommend strategies.

You can, however, use it to develop and sharpen your options strategies.

For instance, you can use the options calculator to identify options contracts that you can repeatedly sell for regular income, options contracts designed for big income but with a big chance the stock will change hands, and options contracts designed to transfer the stock.

Personally, I currently focus on selling options contracts that expire 3 to 4 months from the current date.

My preferred outcome is usually for the option contract to expire out of the money.

That means I keep the money the option buyer paid me for the option contract and the underlying stock does not change ownership.

I usually do not want the stock to change ownership because I want to be able to repeat the option strategy.

I want to repeat it because I am trying to create regular income, like a dividend for stock owners, rent payments for landlords, or royalty payments for artists.

I prefer to sell options instead of buy them because I want the income and that is what I have experience with.

Plus, I do not do margin trading or have experience with strategies for buying options for wealth that fit in with my current overall investing practices.

I like the timeframe of 3 to 4 months because it is oftentimes long enough to get decent options income with a probability that I am comfortable with that the stock will not change ownership.

I feel comfortable trying to predict how my stocks will move in 3 to 4 months.

A year, for instance, is currently difficult for me to feel comfortable predicting how the stock will move. But maybe someday I will target a year or more.

As for timeframes shorter than 3 to 4 months, I am currently exploring ideas but not yet deploying them. If the option income can be good and if I can feel comfortable pricing the strike price, then I will try it.

So I am looking into how to answer the question of how much will the stock move in shorter timeframes, like 5 days, 21 days, 45 days, and more.

Stay tuned for more features

Whether you are a buyer or seller of options, let me know what you think of the options calculator and what features you want me to add to it.

For instance, I am thinking of the following.

more price history tables for a variety of timeframes

save favorite rows from options tables

create a list of deployed options contracts

Regardless of whether you use the options calculator, be sure to do your own research and consult a qualified and trusted financial advisor before buying and selling stocks, options, and other securities.