Secured Put Example

Make 3% passive income in roughly 3.5 months and possibly pick up shares of a great company by selling a secured put option.

Read below for the following.

Brief intro to secured put options

Why sell a secured put option

Example secured put scenario

Real examples of secured put strategies for the Texas Instruments Incorporated (TXN) July 21 2023 options chain

Secured Put

A secured put is when you sell someone the option to sell shares of stock to you for which you already have money set aside for.

The put is considered secured because you already have the money to buy the shares and can therefore deliver the cash if the option buyer exercises the option.

The put is not secured if you sell the option but do not actually have the money set aside for buying the shares. That is considered margin trading and is beyond what we do here.

Otherwise, the put is typical. The buyer can put the shares on you if the stock price drops below the strike price.

Why sell a secured put?

Option sellers sell secured puts for many reasons.

Income is one main reason. Selling the option generates income.

Selling secured puts can earn you annualized returns around 10% before taxes. More or less aggressive strategies change that percentage, but it is a decent ballpark estimation.

Checking and savings accounts cannot match that with 1-2% yields. Even good dividend stocks are less, maybe around 3-5% yearly.

Secured puts are riskier and require more hands on work than bank accounts and dividend stocks, but you may like that about options.

The returns are good and it is fun analyzing, making decisions, and following the news, company, and stock results.

As a side note, I never did fantasy sports, but following stocks and options seems like my version of fantasy sports.

But instead of things like teams, athletes, playoffs, media, and games, it is companies, employees, media, earnings reports, products, innovation, marketing, and things you actually touch and experience in real life.

Is Apple going to be above $180 in July?

What is the news about Facebook’s AI and efficiency push going to do to the META stock price?

What impact does chatGPT have on Microsoft and Google stock prices?

How will Disney and Starbucks ever replace their CEOs who keep returning to run the companies after stepping away?

Just like bank accounts and stocks play specific roles in your financial life, options are just another tool that you can use. When used correctly, options can be fun and financially rewarding.

Another main reason to sell secured puts is to buy shares of a good stock at a lower price. Different strategies exist for using puts to buy shares at lower prices. It depends on your investing goals, portfolio composition, and other factors.

This newsletter gives simple examples to help demonstrate various ways to price secured puts for generating income, picking up shares, and both.

Here is one example.

Example Secured Put

Pretend Cash Enterprises trades at $30 per share and that you have $2,700 in your investment account set aside for selling options.

You like the stock long term and actually already own shares.

The stock has been moving up steadily and consistently lately. You want to take advantage of that upward trend with a put position.

So consider a put position that catches shares for you if the stock takes a break from its upward climb.

The risk is that the stock keeps zooming upward while your money sits on the sidelines. Instead of using the $2,700 to buy actual shares and get their subsequent increase in value, you have the $2,700 sitting flat as cash for securing the put.

Other factors might outweigh that risk, though. Consider these.

the option income is good

you already own a significant number of shares

a real chance exists that the stock will dip

a good chance exists the stock will not take off like a rocket without you

if you do not buy shares as the option seller, you can always buy them after the option expires

So here is what you do . . .

You sell an option for 85 cents per share.

This totals $85 because an option contract is for 100 shares. The option contract expires in 3.5 months with a strike price of $27 per share.

Only if the stock decreases more than 10% in 3.5 months, from $30 to $27, do you have to buy the shares at $27 per share.

Even if the shares are then trading below $27, say for example at $24, you still pay $27 per share.

So you set aside $2,700 to secure the put.

If the option expires with the stock trading above the strike price, you do not buy the shares.

Regardless, you keep the $85 option contract sale price.

What you want . . .

A great outcome is if the option contract expires when the shares are trading just below $27 and then after expiration the stock increases.

You keep the $85. A more than 3% gain on your $2,700 cover in 3.5 months.

You also get shares that are increasing in value. Anything above $27 per share means your $2,700 security used to buy the shares is now greater in value.

You could sell the shares for much higher in 3-5 years and sell covered calls.

One risk, however, is that after buying the shares, the stock drops and does not recover.

That is why it is important to sell secured puts for stocks that you think will increase in the long term from its current value.

If the stock does drop big, then the problem could be a stock picking problem, not an options strategy problem.

So what if the option expires and the stock trades below the strike price . . .

If the stock trades below $27 at the option contract expiration date, you keep the $85 option income and buy the stock for $27 per share regardless of what its actual price is.

In total, your net spend is $2,615.

$85 - ($27 x 100 shares) = - $2,615One way to think of it is that you purchased the shares for $26.15 each. Because when you subtract the option income of 85 cents per share from the $27 price you paid per share, you get $26.15.

Therefore, so long as the stock stays above $26.15, your $2,700 purchase is profitable.

What if the shares do not fall below the strike price during or after the option contract period?

In 3.5 months, you made a more than 3% gain on your $2,700 by earning $85.

Annualized, that is over 10%.

If your $2,700 were sitting in a savings account instead of working put security, it would only earn 1-2% per year.

You do not get the shares but you turned $2,700 into $2,785.

Despite your sweet annualized option income, you miss the stock’s upside.

Pretend the stock increased from $30 to $36 in the months during or following the option expiration. A 20% increase. The put expired unexercised, so you did not get the shares.

Instead of securing a put with the $2,700, had you bought shares you would have realized a 20% gain instead of your 3% from the $85 option income.

That is why it is important to sell secure puts for stocks that you are comfortable not buying through the option.

For instance, maybe you own other shares of this stock so you already are in for the upside. Or maybe you like the stock but want to get it at a lower price for some reason.

In addition to losing out on upside, your $2,700 is less valuable as security on options for that stock.

For instance, if the stock increases above $30 per share to $35, option buyers will offer you less money for an option at $27 because now $27 is less likely to result in the option buyer being able to put the shares on you.

This highlights that if you really like the stock, you should strongly consider buying shares straight up instead of hoping to buy shares by selling a secured put.

It also highlights that you can select a strike price more or less aggressively depending upon how badly you want shares or how likely you want it to be that you buy shares.

If you really want the shares but also want the option income, price the option strike price near or above the current price.

A higher strike price is one factor that increases chances the stock price will be below the strike price at expiration and therefore the shares put on you.

Strike price is not the only factor that impacts the probability of the option being exercised, so be careful not going too high with the strike price or else you risk way over paying for the stock.

Real Example Analysis

Consider a real example using TXN.

TXN is Texas Instruments Incorporated. TXN designs and manufactures semiconductors and various integrated circuits.

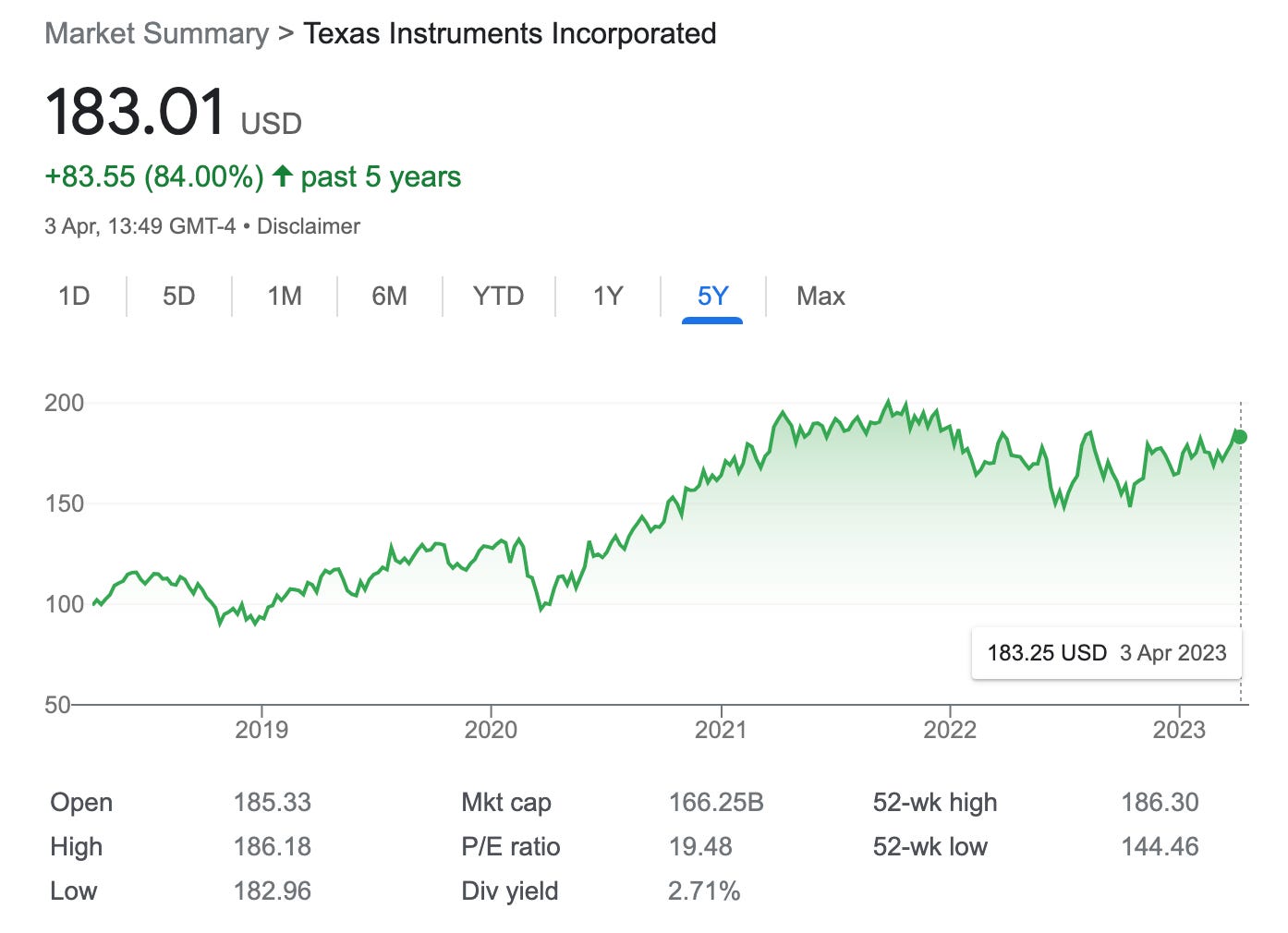

Here is the TXN stock chart for the last 5 years.

TXN is up 84% in the last 5 years but relatively flat the last 2 years.

As of April 3, 2023, TXN trades at around $183 per share.

From April 3, 2023 until July 21, 2023 is a little more than 3.5 months.

Here is the options chain for the July 21, 2023 put options for TXN from Yahoo Finance.

Look at the options chain for a strike price below the current price of $183 per share.

But how much below? Is a $183 strike price okay? How about $160? Something else?

It depends on your investing goals and I have a few examples below to highlight that.

You cannot predict where the stock price will be when the contract expires.

You can, however, look at past performance to make an informed decision to help stack the odds in your favor.

Consider the past performance of TXN.

Although past performance is not a guarantee of future results, it can nonetheless be informative sometimes.

Check out the chart below.

TXN is up more than 10% in the 90 days preceding April 3, 2023.

Last year at this time, TXN shares were up 0.22% over the preceding 90 days, from Feb 2022 until April 3, 2022. Then it fell more than 16% over the following 90 days, from May through July.

Two years ago at this time, it was up more than 14% over the preceding 90 days, from Feb 2021 until April 3, 2021. Then it fell almost 3% over the following 90 days, from April until July.

See the chart below for the last 5 years.

Looking at the next 90 days for each of the last 5 years, the last 2 years the shares decreased but the 3 years before the shares increased.

In the years the shares fell, they fell ~16% and ~3%.

In the years the shares increased, they increased ~25% one time and the other times around 1% to 4.5%.

Look at the options chain again but with some calculations . . .

Below is the same options chain as above but with three new columns on the left. I added the columns with a Chrome extension that I made for Yahoo Finance’s options pages.

The left column is called Price %.

It is the price change from the current price to the strike price. So you can know how much the stock would have to move for the shares to be put on you.

The column to the right of it is called Inc % Stock.

It is the option seller income in terms of the current stock price.

I took the either the last price or the average of the bid and ask prices if they exist in the Yahoo table, divided the result by the current stock price, and multiplied that by 100.

So you can know how much that security is working for you as option seller income in terms of the current stock price.

The column to the right of it is called Inc % Strike.

It is the option seller income in terms of the current strike price.

I took the either the last price or the average of the bid and ask prices if they exist in the Yahoo table, divided the result by the current strike price, and multiplied that by 100.

So you can know how much that security is working for you as option seller income in terms of the current strike price.

If you want shares of TXN but are okay with potentially not buying them, consider the potential options income strategy below.

If you select a strike price of $170, you earn roughly $530 as option income and have a significant chance of having the shares put on you after the option expires. See the highlighted row in the table below.

The $530 option income is based on the bid and ask prices of 5.20 and 5.40 times 100 shares.

The $530 earns you 3.11% of the $17,000 cover in just over 3.5 months.

The stock needs to decrease more than 7% from today’s price for the option buyer to put the shares on you.

In the last 2 years when the stock was down around July 2023 from the April price, it was down 16% and 3%, so a strike price at 7% below today’s price means a chance exists for the stock to decrease below your strike price.

Keep in mind that the stock might not drop.

It could increase between now and contract expiration. Like it did 3, 4, and 5 years ago.

According to the chart above, however, it is unlikely that the TXN will increase so much that you will miss out on big gains from this one option trade.

Therefore, if the option contract expires without you getting the shares, a chance exists for you to buy shares at a good price or to make money on TXN in other ways.

Although the chart may be helpful to you, you cannot consider just the 5 year chart. You also have to consider current market conditions and other factors beyond the scope of this example.

Remember to do your own research and not rely just on this article.

Regardless of whether the option buyer puts the shares on you, the $530 is yours.

A 3.12% increase on your $17,000 in 3.5 months!

($5.30 / $170) * 100 = 3.12%Annualized that is around 10%.

Look at the Inc % Strike column in the chart above to confirm for the line marked in red.

If you want to increase option income and also the chance of the option buyer putting the shares on you . . .

If you select a strike price of $180 dollars, you earn roughly $860 as option income. The $860 is based on the bid and ask prices of 8.50 and 8.70 times 100.

A 4.78% increase on your $17,000 in 3.5 months. A much higher increase in option income. Annualized that is over 15%.

With it comes a greater chance the option buyer puts the shares on you because the strike price is only a 1.64% drop from the current price.

Therefore, although the annualized return is good, it is perhaps not a sustainable options strategy for an entire year. It depends on future prices and whether you pick up shares.

If you are not comfortable with the risk of having to buy at the $170 and $180 strike prices but still want option income . . .

To reduce the chances the option buyer puts the shares on you and yet still have some decent option income, consider a strike price of $155.

You earn roughly $240 as option income.

A 1.57% increase on your $17,000 in 3.5 months. That matches most savings accounts in a third of time.

Plus, the stock has to drop over 15% for the shares to be put on you.

Note, in the examples I looked at the Inc % Strike instead of Inc % Stock column because that is more interesting to me when selling a secured put because the strike price is what determines how much cash I have sitting on the sidelines securing the put.

You also can consider the Inc % Stock. That helps you understand how much your income is in terms of the value of the stock at stake based on the April 3, 2023 price.

Summary

If you want to sell a secured put with a significant chance of the options buyer being able to put the shares on you, consider a strategy similar to the $170 strike price for TXN above.

The option income is good and the stock has a chance of dropping to that price by contract expiration.

If you want more income with a greater chance of picking up shares, check out the $180 strike price.

Finally, if you want decent income but a lower risk of the buyer putting shares on you, consider the $155 strike price.

Remember to do your own research before investing in stocks or selling options. Do not rely just on this article as my information may not be timely or accurate.

Make smart decisions and do not take on more risk than you feel comfortable with. Consult a professional financial advisor instead of relying on my information.

I sometime own shares of stock or hold options positions on the companies I write about.